Bayport Blog

It costs money to borrow money

Published: 2022-03-01

Categories: Credit Health

Tags: Credit Health, Credit Wellness, Financial Literacy

There are lots of credit providers out there making credit promises. One of the big things to consider and understand before making a deal, is how much your credit will cost.

When you pay for something, you usually have different payment options: cash, debit order, lay-by, store card, bank card, credit card or a loan. Whenever money doesn’t change hands immediately, you are using credit.

Credit has three elements:

1. Risk: there is always a risk that a person will not pay back the money he or she borrowed.

2. Time: money is borrowed over a specific period, such as six months or a year.

3. Costs: when you borrow money, you have to pay interest and other costs such as service and initiation fees.

The costs of credit

Make sure you know what all these costs are before you enter into any credit agreement:

• Principal – the amount you need to borrow.

• Service fee – a monthly administration fee. Credit providers may charge up to R50 per month.

• Interest – the amount the credit provider charges you for the opportunity to borrow money. Interest is charged as a percentage of the principal amount. The National Credit Act (NCA) stipulates the maximum interest that may be charged.

• Initiation fee – a once-off amount the credit provider charges you for entering into the credit agreement.

• Default administration charges – fees that are charged when you fall behind in your payments.

• Collection costs – fees that are charged when the credit provider tries to collect outstanding debt from you.

• Credit insurance – credit providers may demand that you take out a policy that will settle your debt in case of death, disability or retrenchment. You have the right to use an existing policy instead of taking out a new one.

Make sure that your pre-agreement quotation and your credit agreement show all these fees and costs, including 15% VAT. It should also show you the total cost of your loan for the full period. That’s the only way you can tell whether or not you can afford the loan.

Creditworthiness and affordability

Two factors that can increase or decrease your cost of credit, are affordability and creditworthiness.

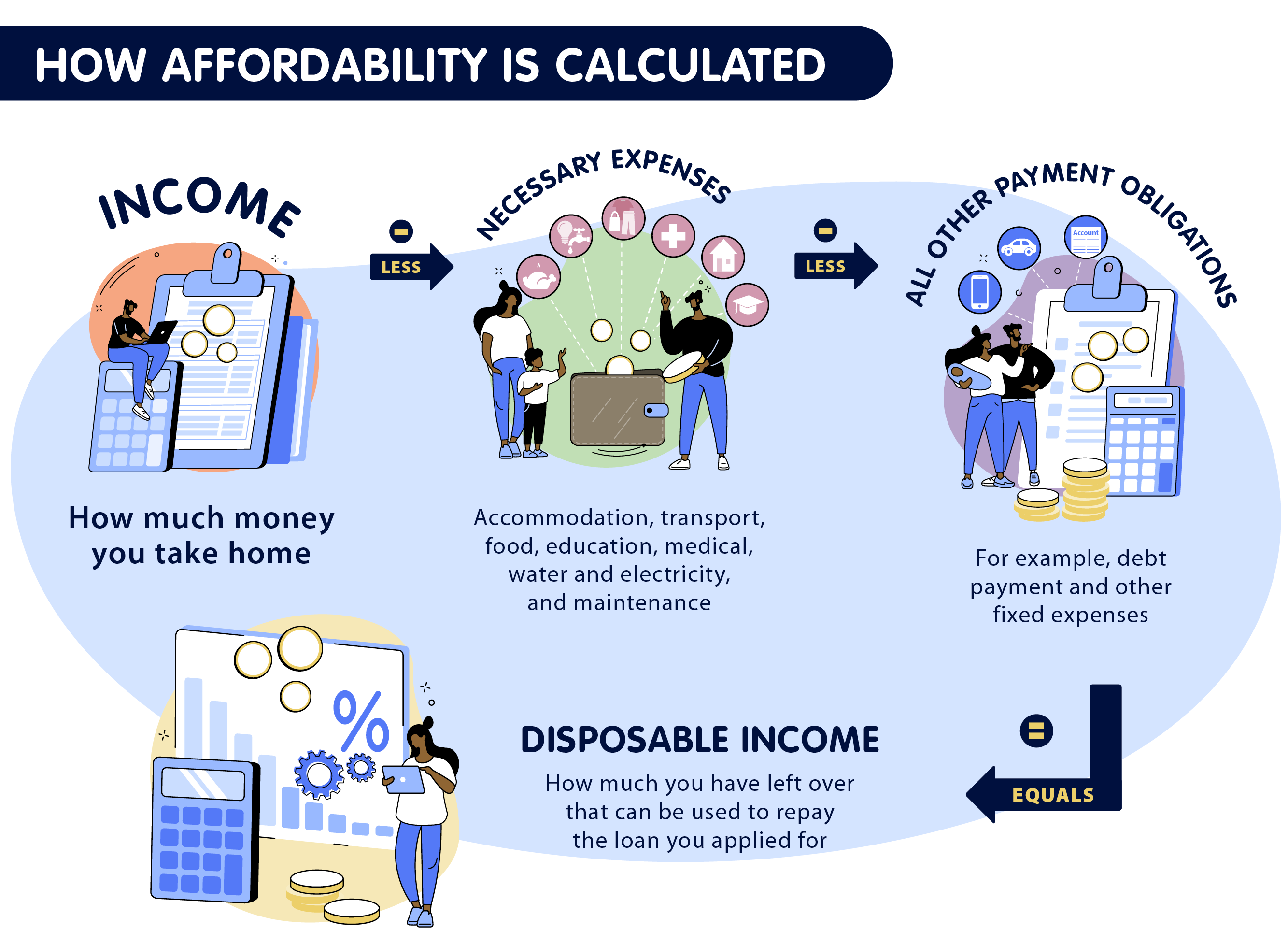

Affordability means that the credit provider tries to determine if you can pay back the loan. The NCA tells credit providers how to decide a consumer’s affordability.

Creditworthiness means that the credit provider tries to determine if you will pay back the loan. This involves looking at your payment history to see if you are a high-risk or low-risk borrower. The lower the risk, the higher your creditworthiness and the better your chance of getting a loan. A good risk profile could also mean you get a lower interest rate.

• How affordability is calculated

• How creditworthiness is determined

The credit provider contacts credit bureaus to carry out a credit check. Your credit report and credit score determine your creditworthiness.

Once the credit provider has all the information it needs, it compares your affordability and creditworthiness to the amount of money you have asked for and the period over which you want to borrow it. The credit provider also looks at the risk it is willing to take. Based on all these factors, the provider then decides how much it is willing to lend to you, for how long and at what interest rate.

The bottom line

Credit is never cheap, but if you understand and manage it properly, it can be a useful tool on your way to financial wellness.

Remember also that debt is not your enemy. Bad credit habits are. Therefore, always think carefully about when and how much to borrow, and make sure your financial habits help you build a healthy credit score.

• How creditworthiness is determined

The credit provider contacts credit bureaus to carry out a credit check. Your credit report and credit score determine your creditworthiness.

Once the credit provider has all the information it needs, it compares your affordability and creditworthiness to the amount of money you have asked for and the period over which you want to borrow it. The credit provider also looks at the risk it is willing to take. Based on all these factors, the provider then decides how much it is willing to lend to you, for how long and at what interest rate.

The bottom line

Credit is never cheap, but if you understand and manage it properly, it can be a useful tool on your way to financial wellness.

Remember also that debt is not your enemy. Bad credit habits are. Therefore, always think carefully about when and how much to borrow, and make sure your financial habits help you build a healthy credit score.