Bayport Blog

Dealing with debt: you have options

Published: 2022-03-29

Categories: Debt Relief

Tags: Debt Consolidation, Debt Counselling, Debt Relief

Debt consolidation. Debt counselling. Debt administration

How do you decide which one is best for you and how do you avoid being scammed? We have the answers right here.

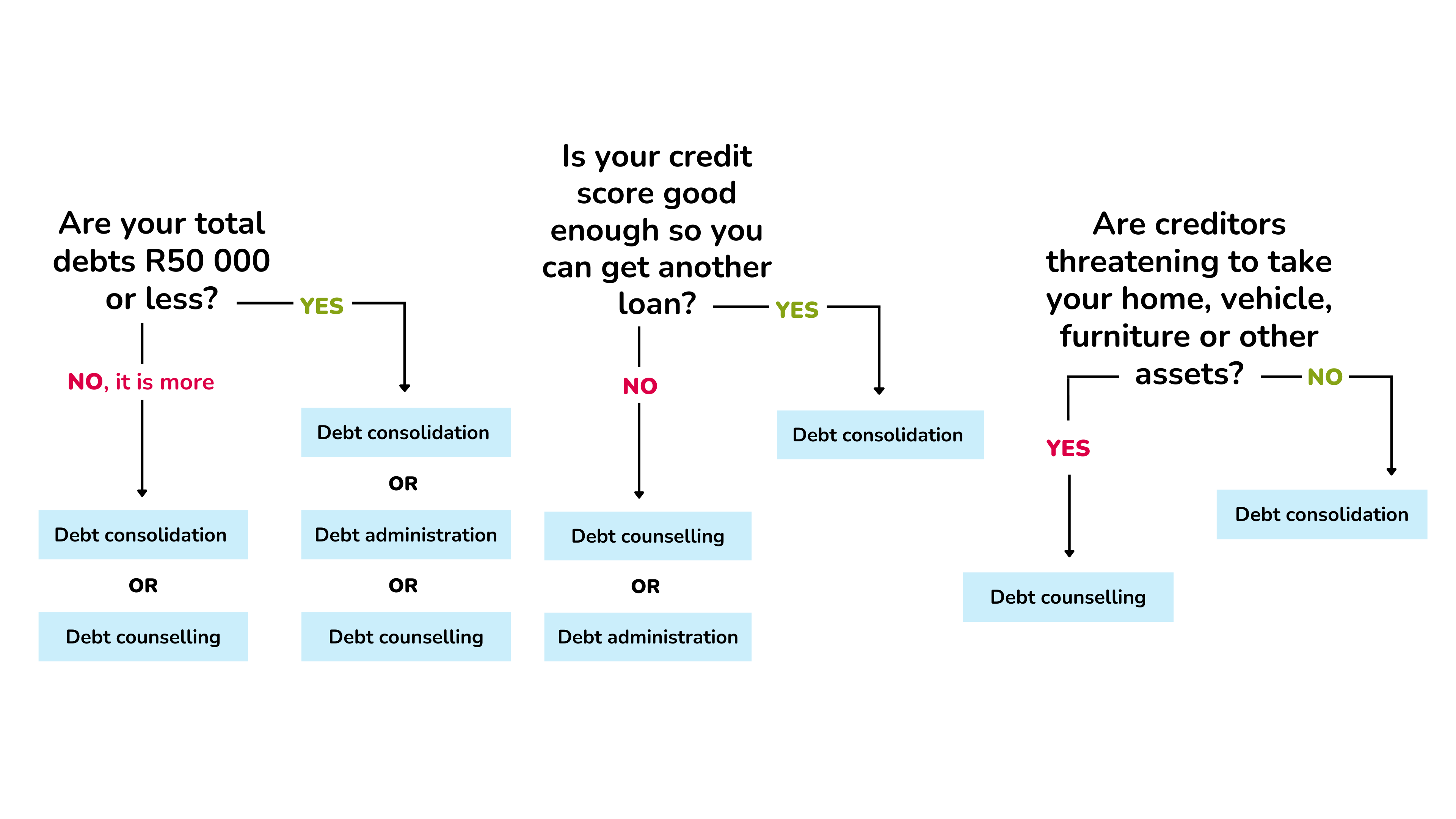

When you feel like you are drowning in debt, you have three options, depending on your specific circumstances. They are debt consolidation, debt counselling and debt administration.

Counselling and administration are both legal processes because the courts are involved, and both of them have costs attached that you need to pay.

Debt consolidation, in contrast, is not a legal process and you don’t have to pay a debt counsellor or administrator. The only fees involved are the usual loan fees and interest on the consolidation loan you need.

Here is a simple checklist to get you started:

When should I consider debt administration?

• When you need legal protection from your creditors, and/or do not qualify for a consolidation loan due to over-indebtedness and a poor credit score.

When should I consider debt counselling?

• When you run the risk of losing your assets, ie when the bank threatens to repossess your home, vehicle or other assets you have. While you are under debt counselling, and even in the 60 days while your review application is being considered, your creditors cannot take action against you.

• You should also consider debt counselling when you are too indebted to qualify for a debt consolidation loan.

When should I consider debt consolidation?

• When there is no risk that you can lose your home, car or furniture.

• If your credit score is good enough that you can qualify for a consolidation loan, or if your employer has partnered in Bayport’s financial wellness programme called Bayport Money Solutions.

Debt counselling and an administration order both attract extra fees and you have to stay in the process until all your debt has been settled. This can take a very long time, during which you cannot get any more credit.

With a debt consolidation loan, the only fees involved are the ones related to your loan, and the loan term would be maximum 72 months. More importantly, there is no adverse notice on your credit record; only the consolidation loan will reflect on your record, which means you can get more credit when you can afford it.

Lastly and VERY importantly: can you be forced into, or placed under, debt administration or counselling without your knowledge and consent?

• No, you CANNOT. Both are voluntary, legal processes for which you have to apply.

• If you find that you have been placed under debt review without your knowledge and consent, you must lodge a complaint with the NCR, and the NCR will investigate the matter.

• You can also contact Bayport Money Solutions for help.

You can get out of debt. The first step is to choose the option that is right for you and to make sure you fully understand the process you choose before you sign any agreement.

When should I consider debt administration?

• When you need legal protection from your creditors, and/or do not qualify for a consolidation loan due to over-indebtedness and a poor credit score.

When should I consider debt counselling?

• When you run the risk of losing your assets, ie when the bank threatens to repossess your home, vehicle or other assets you have. While you are under debt counselling, and even in the 60 days while your review application is being considered, your creditors cannot take action against you.

• You should also consider debt counselling when you are too indebted to qualify for a debt consolidation loan.

When should I consider debt consolidation?

• When there is no risk that you can lose your home, car or furniture.

• If your credit score is good enough that you can qualify for a consolidation loan, or if your employer has partnered in Bayport’s financial wellness programme called Bayport Money Solutions.

Debt counselling and an administration order both attract extra fees and you have to stay in the process until all your debt has been settled. This can take a very long time, during which you cannot get any more credit.

With a debt consolidation loan, the only fees involved are the ones related to your loan, and the loan term would be maximum 72 months. More importantly, there is no adverse notice on your credit record; only the consolidation loan will reflect on your record, which means you can get more credit when you can afford it.

Lastly and VERY importantly: can you be forced into, or placed under, debt administration or counselling without your knowledge and consent?

• No, you CANNOT. Both are voluntary, legal processes for which you have to apply.

• If you find that you have been placed under debt review without your knowledge and consent, you must lodge a complaint with the NCR, and the NCR will investigate the matter.

• You can also contact Bayport Money Solutions for help.

You can get out of debt. The first step is to choose the option that is right for you and to make sure you fully understand the process you choose before you sign any agreement.