Bayport Blog

Now is a good time to get your credit health in order

Published: 2020-04-02

Categories: Financial wellness

Tags: Financial Planning

With most of us confined to our homes and unable to go about our usual business, it is a great opportunity to not only look after your physical health, but your credit health as well.

A primary indicator of your financial wellness is your credit score or credit rating; it is like taking your credit health’s temperature.

What is a credit score?

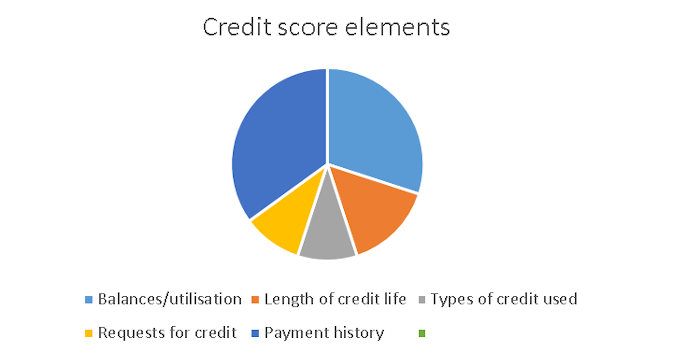

Your credit score is drawn from your credit report, and is made up as follows:

The higher your credit score, the better as it means that you are a low risk customer to the credit provider. The lower your score, the higher the risk you present to the credit provider.

Information does not stay on your credit profile forever, therefore you can improve your credit score by being responsible with credit.

What is a credit report and where does it come from?

A credit report is a record of your borrowing behaviour, and is compiled by credit bureaus. It includes:

- Personal information that identify you, including your name, ID number, all known addresses and telephone numbers and your employment history.

- Details of all the accounts you have with banks, shops, credit card companies and other credit providers.

- Your payment history for every account over the past 24 months.

- Any legal action that have been taken against you for the non-payment of credit.

- Details of everybody who has asked for copies of your credit record in the past year. This means you can see who has looked at your credit report and when. It is very important that you check no enquiries were made of which you were not aware, as this could mean that someone is trying to apply for credit in your name.

- If you have ever been a victim of fraud, there will be a fraud alert on your credit report. A warning will also appear if you are under administration or debt restructuring.

Why is a good credit score important?

Your credit profile shows how you manage your money and how responsible you are when it comes to repaying debt. It tells credit providers how creditworthy you are, in other words, how likely it is that you will pay back a loan according to the terms of the credit agreement.

Also, when you apply for a job, the company might want to see your credit profile, and when you want to rent a property, the letting agent will definitely look at it.

Where do I start?

- Before you can fix your credit score, you have to know what it is. You are entitled to one free credit report every year. Simply send a WhatsApp to 087 240 5555 and Bayport will help you get a copy of your credit report. You can also request your report from our website or by using our mobile app.

- Check that all the information on the report is correct. If there are any mistakes, contact the credit bureau immediately to have it fixed.

- Use the information on your report to guide your actions.

How do I improve my credit score?

The short answer is: by managing your money. Here are some practical tips that you can implement right now:

- Set a budget and follow it.

- Keep track of every cent you spend and use this spending information to refine your budget and identify opportunities for savings.

- Start saving and build an emergency fund so that you don’t always have to borrow.

- Pay your bills and instalments on time.

- Pay accounts in full.

- Pay more than the minimum instalment whenever you can.

- If you’ve missed a payment, get back on track as soon as possible and stay on track.

- Never ignore overdue accounts. If you are struggling, contact your credit provider to make an arrangement. It is the best you can do for your credit health and for your peace of mind.

By managing your money well, you make it possible for yourself to get credit when you might need it. A good credit score will show a credit provider that you are creditworthy, while proper budgeting and careful spending will improve your affordability rating.

As with your physical health, credit health takes focus, effort and good habits, but the results are definitely worth it.

For more information on personal loans, visit https://www.bayportsa.com/products-services/personal-loans-online/

Go back