Information centre: Financial wellness

Credit opens up a world of possibilities and opportunities by providing access to big-ticket or high-cost items. The good news is that these situations in which loans spent on growing assets or securing your future are referred to as “good credit”.

Learning outcomes

- Identify key tips for responsible borrowing.

- Interpret what does cost of credit mean.

- Understand and apply the steps to applying for credit responsibly.

- Understand the different types of credit.

- Understand what is good credit.

- Understand your rights when applying for credit.

Good credit

With the cost of living escalating rapidly, the average South African finds it hard to pay for a home, car or education with cash only. Credit opens up a world of possibilities and opportunities by providing access to big-ticket or high-cost items. The good news is that these situations in which loans spent on growing assets or securing your future are referred to as “good credit”.

Applying for credit responsibly

You should always be objective and honest with yourself when applying for credit and avoid borrowing with your emotions and for the wrong reasons. Here are some simple guidelines that will help you to apply for credit responsibly.

Step 1: Know your credit status by requesting a credit bureau report from one of the major credit bureaus or from Bayport Financial Services. Remember, you get one free credit report every year. Make sure there are no errors on your report as this will minimise the possibility of having your application declined. Refer to Module 1 to remind yourself about credit bureaus and to get a Bayport Credit Health Report.

Step 2: Do a realistic budget to make sure you can afford the monthly repayment for the new credit.Make sure you have sufficient funds left in your budget for your savings and living expenses. Refer to Module 4 to learn more about budgets and spending.

Step 3: If you can afford the credit, apply by providing true and honest information about your monthly income and living expenses to the credit provider.

Step 4: The information provided by you as well as the information from the credit bureau will be used to calculate the instalment you can afford to pay. This is called an affordability assessment.Your credit application process is only valid once the creditor has made sure you can afford the credit.

Step 5: When the loan application is approved, you will need to read through your contract carefully. Your contract will contain important information about costs, charges, interest rate, monthly instalment and the terms for repaying the loan or the debt. Make sure you read everything in the contract and only sign it when you are satisfied and fully understand it. The contract will become binding once the credit has been approved and the money has been paid out.

Step 6: Make sure you choose the repayment method that will best suit your ability to maintain regular payments. Do not be tempted to take more than you need, go back to your budget and see if you can afford the monthly instalment shown on the quotation, and still have an amount saved for emergencies. If yes, you can proceed.

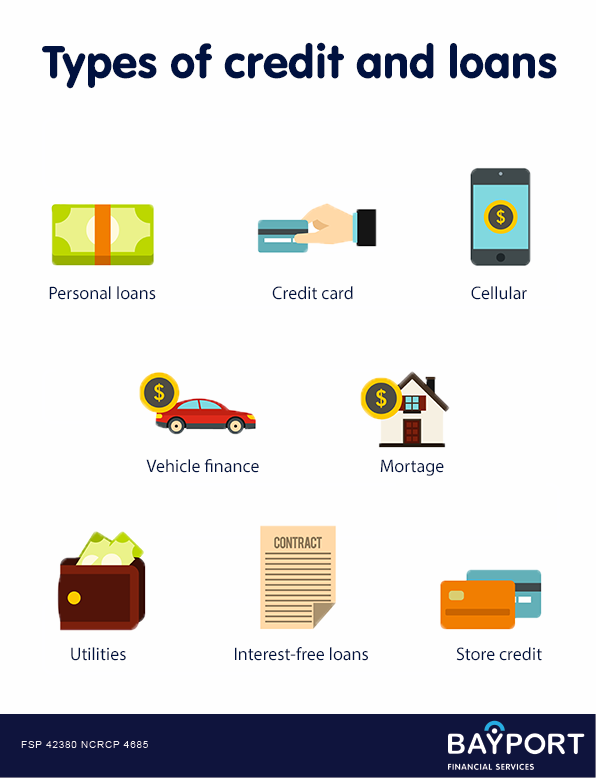

There are four most common types of credit.These include credit facility, credit transactions, incidental credit and credit guarantee. If you have a combination of the four, you demonstrate to creditors that you can responsibly handle a variety of financial obligations provided that all your repayments are up to date.

Even though a small percentage of your credit score is attributed from the mix of credit facilities that you have, this does not mean that you need to have all three types of credit. However, it is still important to understand the different types of credit and how it is best used.

1. Credit facility

For this type of credit you are given a specified credit limit and you can make charges up to that limit. Each month you receive the balance and make a payment, usually a minimum instalment, and you can use the credit again (you revolve the debt). Credit cards, overdrafts and store cards are types of revolving credit.

2. Credit transaction

This refers to when a credit provider loans you an amount of money and you agree to repay the money and interest in regular instalments of a fixed amount over a set period of time. Car loans and home loans are two examples of a credit transaction, as are secured and unsecured loans.

3. Incidental credit

This is a different type of credit that occurs when you do not pay an account for electricity, a cellular phone service, a doctor’s visit, and so forth. Usually, with these services, there is an agreement that you will pay each month or within a specified period, usually 30 days. You only need to pay what is owed with no extra costs, unless you do not pay on the due date when you are then charged interest and costs, and legal action can be taken to recover the amount owing.

4. Credit guarantee

This is where a third party, such as a family member, agrees to pay a credit provider the amount owed by you, on-demand if you should fail to pay your debt. This is also called suretyship.

Being aware of the cost of credit

When you borrow money there is interest and fees that must be taken into consideration so that you can understand what the credit will cost you over time. The cost of credit is how much it will cost you to repay the money that you have borrowed from a credit provider.There are several factors to take into consideration to determine what the repayment will be:

- Initiation Fee: This is a once-off fee charged for processing a successful credit application.

- Monthly Service Fee: This is a charge that the customer pays every month for the administration and servicing of the account.

- Interest: The interest rate is determined by your risk profile and credit score. Bayport Financial Services offers a tailored interest rate for their employee wellness programme customers.

- Credit Life Insurance/ Credit Insurance: A percentage of the total repayment of your loan will be an insurance premium calculated into your monthly repayment. You have the choice of purchasing credit life insurance cover from an insurer suggested by a credit provider or alternatively to provide the credit provider with an insurance policy of your choice, provided that your own policy benefits are acceptable.

Representative example of a R100,000 loan repaid over 72 months

(including interest, fees and insurance*)| Credit Advanced | Term of Loan | Monthly Insurance Premium | Monthly Service Fee | Total Instalment | |

| 20% | R100,000 | 72 Months | R455.00 | R68.00 | R2,948.00 |

*The amount of the total instalment will remain unchanged throughout the term of the agreement

**Risk Profile Dependent

These costs are explained in full detail within your pre-agreement with the credit provider. Make sure that you fully understand these costs before accepting any credit agreement.

Know your rights

According to the National Credit Regulator, which has been appointed by the government of South Africa, a consumer has the right to apply for credit and is protected against discrimination in the granting of credit. If a creditor does not grant you a loan, you are allowed to request in writing the reason why it has been declined. Here are more rights that apply to you as a consumer applying for credit:

| You have the RIGHT to: |

| Receive a free copy of your credit agreement and also to receive your agreement in plain and simple language. |

| Dispute any amount which you do not agree that you owe. Do not sign your contract if the contract contains information that you do not agree with. |

| Understand all fees, costs, interest rates, the total instalment and any other details. |

| Say no to increases on your credit limit. |

| Have your personal and financial information treated as confidential. |

| Decide whether or not you want to be informed about products or services via telephone, SMS, mail or e-mail campaigns. |

| Apply for debt counselling if you find yourself being over-indebted. |

Borrowing responsibly

No matter what type of credit you choose to service your needs, it is important to make sure that you can afford the credit and pay it off as agreed upon in your contract or as quickly as possible. Borrowing responsibly not only refers to using credit for your needs, but it also means paying responsibly.

Here are tips on how to ensure that you pay your debt in a responsible way:

- Pay off your most expensive debt first – typically credit cards and personal loans but don’t skip payments on secured assets such as your car or home because you might lose your security.

- Avoid using debt on which you have to pay interest to buy consumables. This makes everyday items far more expensive.

- Never pay debt with debt.

- When applying for credit, remember that the higher the interest rate, the higher your monthly instalments and the more expensive the loan will be. The longer the loan term, the less the monthly instalment will be. However, if you are borrowing money for a longer period, the total amount that you repay at the end of your term will be more.

- You may request a pre-agreement quotation that will be valid for a few days before taking up the credit to help you to determine if you can afford it.

- It is recommended that you pay your debt on the day that you receive your salary in order to maintain a good credit record.

Now that you are aware of your finances, your rights, types of credit and how to apply for credit wisely and borrow responsibly, our next module is on how to control your money.