Information centre: Financial wellness

The key to financial health is your ability to plan for your financial needs by allocating money monthly to the areas that you need to budget for, to track your spending, and to plan for your short- and long-term financial goals.

Learning outcomes

- Demonstrate an understanding of what is a Money Plan?

- What does a budget and spending mean?

- Understand and apply the benefits of budgeting

- Understand and apply general budgeting and spending tips

- Formulate and understand financial goals

Introduction

Part 1

Part 2

The key to financial health is your ability to plan for your financial needs by allocating money monthly to the areas that you need to budget for, to track your spending, and to plan for your short- and long-term financial goals.

Understanding a money plan

The key to financial health is the ability to budget monthly. Your budget should make provision for the here and now, but also include room for your future goals like retirement or education. Your future financial well-being is determined by how well you manage your money and payments now. The key to financial health is your ability to plan for your financial needs by allocating money monthly to the areas that you need to budget for, to track your spending, and to plan for your short- and long-term financial goals. Your money plan should make provision for both and should be done on a regular basis. Your budget and spending should be done monthly and your goal setting plan can be reviewed every three to six months.

Budgeting is the most basic and the most effective tool for managing your money. It shows you how to allocate your money and offers you the choice to pay for the most important things first. With a budget you control your money, your money does not control you.

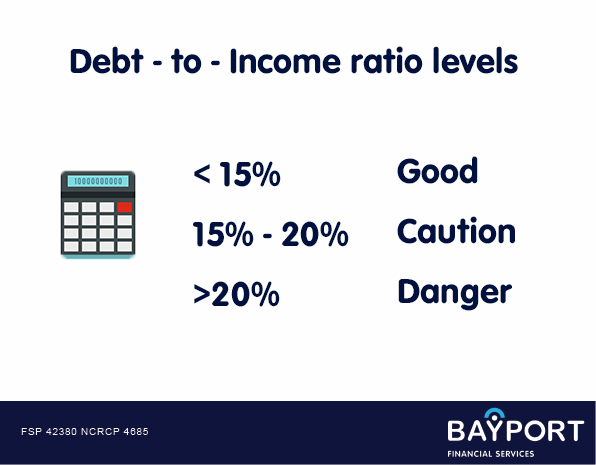

Budgeting clearly shows you how you allocate your money and gives you choices based on your financial limitations. This means you can avoid overspending and be in too much debt. Bayport Financial Services offers a free online budget calculator that helps you create your own personalised budget plan. The ‘Affordability’ section within your own Bayport Credit Health Report, gives a ‘debt-to-income’ ratio. This ratio is broken down into 3 levels, which has been explained below:

Refer back to Module 1 to remind yourself about the Bayport Credit Health Report and to get your free report.

Benefits of budgeting

A budget is a way of being clear about the way you spend and save your money and therefore gives you more control over your money. The other benefits of budgeting include:

| Benefits of budgeting |

| Helps you create a visual spending picture |

| Budgeting saves you the stress of suddenly having to adjust to a lack of funds because you did not plan how to spend your money. |

| It keeps you focused on your money goals: as you avoid spending unnecessarily on items and services that do not help you to meet your financial goals. |

| If you are working with limited resources, budgeting makes it easier to make ends meet. |

| It provides you with an early warning for potential problems: When taking a “big picture” view, you will see potential money problems in advance, and be able to make adjustments before the problem appears. |

| It makes you aware of what is going on with your money: With budgeting, you are clear on what money is coming in, how fast it goes out, and where it is going to. |

| Budgeting saves you from wondering where your money goes every month. |

| A budget enables you to know what you can afford, take advantage of buying and investing opportunities, and plan how to lower your debt. |

| It helps you organise your spending and savings by dividing your money into categories of expenditures and savings, a budget makes you aware which portion of your money should be allocated to your expenses, debt repayments and savings. |

| It helps you determine if you can take debt and how much: Taking debt is not necessarily a bad thing if the debt is necessary or you can afford it. |

| Budgeting shows you how much a debt load you can realistically take without being stressed, and shows you if the debt load is worth it. |

Budget and spending tips

Getting started with your budget may seem like a daunting task, but the following tips will help you to create a practical and realistic plan:

- Do your budget every month by using current figures from your latest payslips, bills, and bank statements.

- Remember to include quarterly or annual expenses and prioritise your expenses.

- It is critical at the end of the month that you track your real spending against your budget. Use your real spending to compile your budget for the next month.

- If you have a shortfall on your budget, see which luxury items you can cut back on, and rather buy these when you have sufficient money.

- Try to pay off debt with your additional income.

- Pay off the credit with the highest interest rate first – this can be understood by reviewing your credit agreement.

- Before you apply for credit or want to make a debt repayment on your arrears, first check how much you can afford to repay. Refer to Module 3.

- Remember to include any additional income that receives from grants, incentives, bonuses, or part-time income, for example. Only add the additional income into your monthly budget plan when you are sure of the exact amount you will be receiving.

- Make your family part of your monthly budget and spending plan to ensure you have their commitment and support.

- Stop making bad choices: Achieving any goal is hard enough without being constantly confronted by potentially bad choices. To improve your chances of success, remove the possibility of making bad choices whenever you can. If your goal is to pay extra on credit card debt, make the payment as soon as the money is available rather than letting the cash sit in your bank account. If credit cards are too tempting, leave them at home.

- Always look for ways to reduce spending. Consider a less expensive telephone plan, use coupons when you shop, and dine out less.

- Search for the best buy. Sometimes it’s better to spend time than money.

- Don’t pay for services you can do yourself.

- Watch out for money drainers – items you buy on a regular basis that can eat up a sizable chunk of your income. For example, 50 cents per day for a can of soda can add up to more than R125 in a year. Think about things you buy regularly that may be money drainers, such as snacks, magazines, or coffee, and consider saving that money for something else.

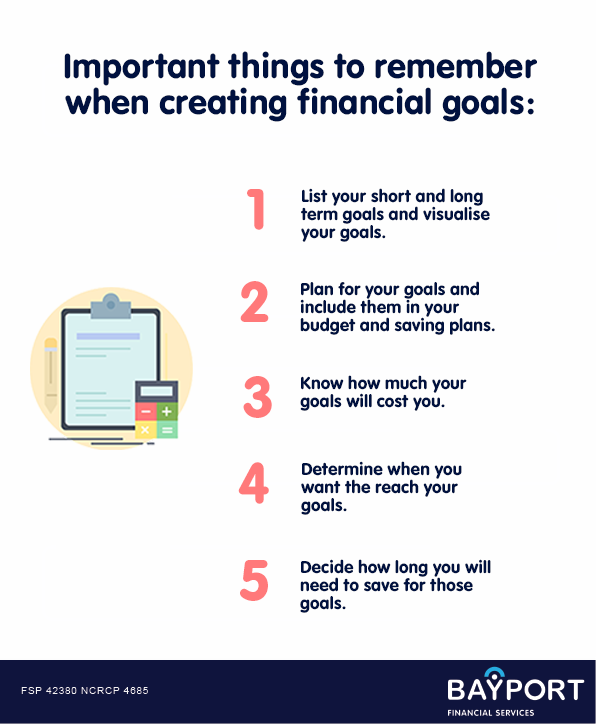

You most probably have financial goals in your life. These are things that you desire or need that you do not have money for at this point in time and are working toward achieving the money to obtain your goals. Here are the most important things to remember when creating your financial goals:

When setting your goals, also take into consideration your family’s needs and think carefully about these. For example, you should not buy a new car if your family does not have a home, or school fees are not paid for.

Setting and achieving your financial goals

Goal setting can only be successful if you understand how to set your goals and then how to achieve them:

- You need to be motivated: One key to successful financial planning is to understand what motivates you. By knowing what drives you, you’ll set goals tailored specifically to you and therefore increasing the likelihood of achieving them.

-

Follow the SMART principle:

- Make your goals specific: Goals need to be specific. A good way to tell if your goals are specific as to ask how you’ll know when you’ve accomplished them. If you can’t answer that question, it’s time to rethink your goals. In addition, goals should be followed up with an action plan. A good start is to ask what your first step will be to achieve the goal.

- Personalise your goal: your money goals should be specific to your circumstances. For example, getting out of debt may require you to make considerable changes to your daily spending habits. In contrast, some people may be in debt due to health issues or a failed business. The key is to understand your specific circumstances and to tailor your plan accordingly.

- Goals and objectives must be measurable – make use of a budget tracker in order to measure your progress to achieve your desired goal.

- It must be achievable. If you aim too high, you may get demotivated and you will not be able to exercise the monthly discipline you need to get there.

- Be realistic : By setting goals that are too easy you will not unlock your full financial potential; if you set goals that are not achievable you will become demotivated. The solution is to be realistic.

- Time-bound – you must have a date in which you hope to achieve your goal and you need to have the discipline to stick to your timelines.

Always remember these goals must be written down so that you can visualise and remember them daily.

Now that you are more aware of how to plan, budget, and control your spending, you are ready to learn more about saving in our next module, Grow Your Money.