Managing your finances during COVID-19

As a result of the Covid-19 pandemic and the knock-on effect on the global economy, hundreds of thousands of South Africans are being forced to review their financial health and personal budgets.

“Consumers are facing debt and personal finance issues unlike any they could have imagined. A few months ago, no one could have envisaged the immense pressure the world’s economies now face. We all need to adapt to a new reality. One area that will certainly need to be relooked is the impact that the COVID-19 has had on debt management,” says Alfred Ramosedi, CEO at Bayport Financial Services.

An untold number of hardworking South Africans have experienced salary adjustments. Some companies have had to retrench staff while others have had no other choice but to close down. Although various service providers have offered debt relief or payment holidays over this period, where does this leave consumers? What does one do when income has decreased yet monthly payments have stayed the same? Ramosedi advises consumers to start by assessing their current situation. For most of us, one or more of the following statements are true:

- I am stuck at home

- My income has decreased yet my costs have stayed the same

- The value of my assets has fallen

- My life is more uncertain

- I have more emotional and financial stress

- I need more, or better financial planning

- I need more, or better financial protection

- I might need financial rehabilitation in future

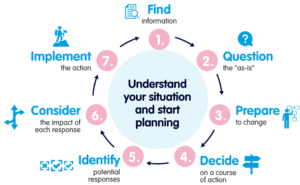

Even though you may feel completely overwhelmed and don’t see any light at the end of the tunnel, there are options and solutions. Follow this seven step model to regain control over your finances:

- Find: Find out as much as you can about your current financial status to allow you to make the necessary decisions and changes. Most information is easily available on your payslip and bank statements. Your payslip will show your gross income and take home salary, whereas your bank statement will tell you more about how much you spend, and on what.

- Question the “as-is”: Take a closer look at the information you’ve gathered, then ask and

answer these critical questions to deepen your financial status understanding.

- What are my financial obligations?

- What is my debt status and credit profile?

- Can I meet my financial obligations?

- Is my monthly cash flow positive or negative?

- How much financial freedom do I have?

- What are the benefits of lower interest rates?

- Is it worth taking advantage of payment holidays and debt consolidation loans?

- Do I need to sell assets? What are my assets worth if I sell them now?

- Which actions will make a difference? Remember that this can be a combination of many small actions or fewer larger ones.

- Prepare to change: Now that you have intimate knowledge of your financial status, you must prepare for change. Change can take different shapes depending on the individual’s financial status.

- Decide on a course of action: This is about aligning your existing budget to your current situation. Ramosedi says now that your income has decreased, you cannot continue to spend as if nothing has changed. An example is where someone has been placed on involuntary leave or was being paid 30% of their salary. “This consumer created a three-month plan which included all her financial obligations, subtracted from the 30% income. For each month she plotted different scenarios, such as cancelling fibre, spending less on groceries, negotiating with creditors for lower monthly repayments on her debts.” With the new numbers in front of you, the new reality of your financial situation should be clearer. It might not be a pretty picture but seeing the picture clearly, empowers you to put plans in place.

- Identify potential responses: Now that your restructured budget shows where there should be adjustments, you need to distinguish between essential and non-essential expenses. Should you cancel a membership or policy? Do you really need that premium subscription? There are other interventions, like debt consolidation, where you pay one lower instalment for several recurring payments.

- Consider the impact of each response: Track your expenses against your budget and make the necessary adjustments as you go.

- Implement the action: This is about discipline and long-term financial wellness and being able to consistently implement the measures you’ve put in place to control your finances. Stay the course – once you have committed to an action plan, stick with it.

By following these steps and being disciplined, you will be in a better position to take charge of your financial situation.